Salary and payslip in France: deciphering

Every job deserves a salary, and every employee must receive a pay slip. It proves that he has done a job. It is his proof of payment, essential for daily life, especially for housing. But the payslip is sometimes difficult to understand: let’s decipher it.

Usually, the number we are most interested in on our paycheck is at the bottom of the page, after the “net pay”. Why is it so different from the gross salary?

Gross salary, net salary: what’s the difference ?

The gross salary is the remuneration fixed in the employment contract. Written at the top of the payslip, it includes all the hours worked, possibly overtime, bonuses…. On this sum, social and fiscal contributions, such as the Contribution Sociale Généralisée (CSG) are deducted. What remains after these contributions is the net salary.

All employees, regardless of their status, management or not, contribute, it is mandatory. Example for a SMIC: the gross salary is 1.681,98 euros (August 2022). It is 1.333€ net. See the URSSAF simulator for the distribution of charges. The law fixes all the mentions appearing on a pay slip.

Gross salary, net salary: where does the difference go ?

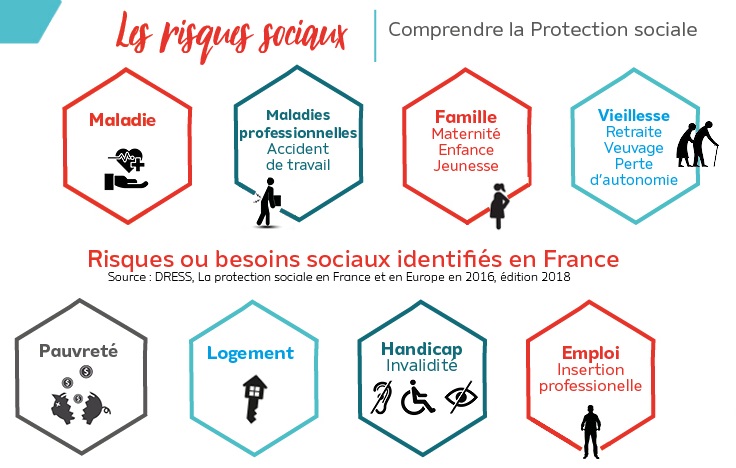

Social contributions are used to finance social protection in France. They cover sickness, old age, maternity, unemployment, family allowances, work accidents, and supplementary pension schemes… Employers also contribute to this protection and to other specific contributions by paying employer contributions.

Image : mutualité française

It should be noted that with the employer’s contributions, for an employee to receive 1799 euros net on a gross salary of 2 300 euros, the position will cost the company 2 948 euros. See the calculation here for a median salary.

If you https://www.service-public.fr/particuliers/vosdroits/F1419?lang=enpay taxes, the amount will be deducted from your paycheck each month. You will then have an additional line “net payable before income tax”. Your payment will be spread out over twelve months: this is called deduction at source.

To go further :

Find in this official site of the French administration all the information concerning the remuneration in the private and public sector: payslip, salary, contributions…

You have just started a business and want to know how much your first employee will cost you in charges? The URSSAF simulator is here.

Video :

Laeticia Avia explains how social protection in France is linked to labor law. Other videos about work in the Ensemble en France playlist.